The financial markets are dynamic, with ever-changing conditions that can challenge even the most seasoned traders. In such an environment, having a reliable and precise indicator is crucial for making informed trading decisions. Traders can use the Arrows indicator across a wide range of financial assets, making it a versatile tool for those active in different markets.

One such tool that has gained popularity for its accuracy and versatility is the Arrows indicator. In this article, we will explore the intricacies of Arrows indicator strategies, focusing on their application to various financial instruments, including Forex, cryptocurrencies, metals, stocks, and indices.

Precision in Trading Signals

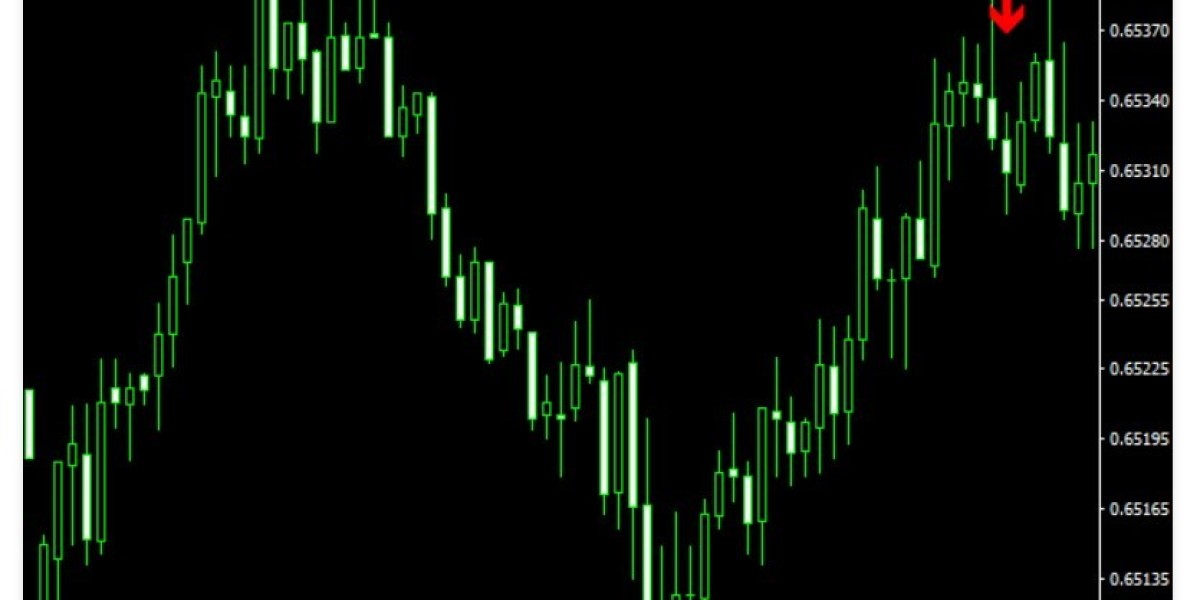

The primary purpose of the Arrows indicator is to provide precise trading signals. Traders can leverage these signals to identify optimal entry and exit points for their trades. The precision offered by the Arrows indicator is particularly beneficial for traders looking to enhance their overall trading results.

Opening and Closing Trades with Confidence

One of the key challenges in trading is knowing when to open and close a trade. The Arrows indicator addresses this issue by offering clear signals based on market conditions. Traders can use these signals to make informed decisions, thereby increasing their confidence in executing trades at the right moments.

Improving Results in the First Week

One notable claim associated with the Arrows indicator is its potential to improve trading results within the first week of use. This rapid impact is attributed to the indicator's ability to provide accurate signals, allowing traders to quickly adjust their strategies and capitalize on favorable market movements.

Implementing Arrows Indicator Strategies

To make the most of the Arrows indicator, traders need to understand how to implement effective strategies. Here are some key considerations when incorporating this indicator into your trading approach:

1. Trend Identification

The Arrows indicator can assist in identifying trends in the market. Traders can use this information to align their strategies with the prevailing market direction, increasing the likelihood of successful trades.

2. Risk Management

Precision in trading signals does not negate the importance of risk management. Traders should still implement effective risk management practices to protect their capital. The Arrows indicator can complement these efforts by providing additional insight into potential market reversals.

3. Timeframe Considerations

Different timeframes may require adjustments to your trading strategy. The Arrows indicator's effectiveness can vary based on the timeframe used, so it's essential to experiment and find the settings that align with your trading style and objectives.

Conclusion

The Arrows indicator stands out as a valuable tool for traders seeking precision in their trading signals. Its versatility across various financial instruments, coupled with its ability to provide accurate signals without redrawing, makes it a compelling choice for both novice and experienced traders. By understanding the nuances of Arrows indicator strategies and incorporating them into your trading approach, you can potentially enhance your results and navigate the dynamic landscape of financial markets with greater confidence.